The dream of owning a home is a powerful one, deeply rooted in our desire for security, stability, and a place to call our own. However, the rising cost of real estate can often make this dream seem unattainable, especially for first-time buyers or those on a budget. But, with careful planning, smart strategies, and the right partner, affordable homeownership is within reach.

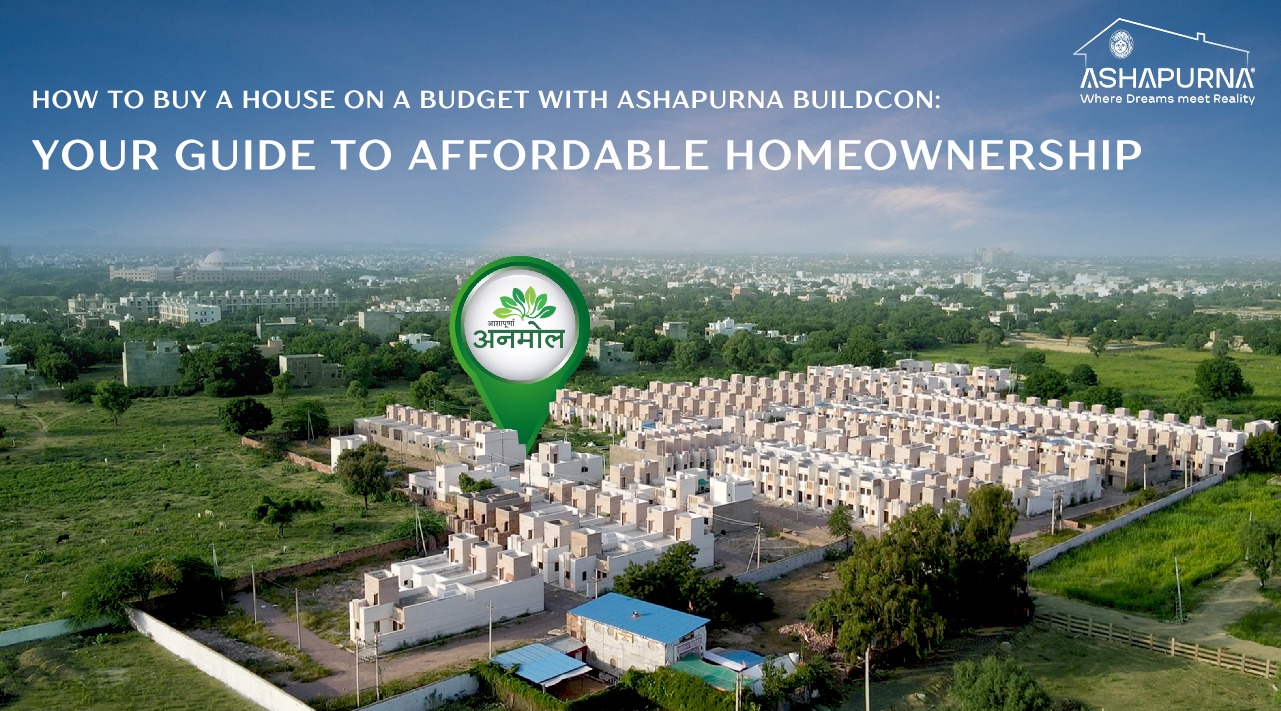

At Ashapurna Buildcon, we believe that everyone deserves the opportunity to own a home. With decades of experience in crafting quality residential spaces in Jodhpur and beyond, we understand the challenges and aspirations of budget-conscious homebuyers. This article provides a comprehensive guide on how to navigate the home-buying process on a budget, and how Ashapurna Buildcon can help you achieve your dream of homeownership.

1. Know Your Financial Landscape: The Foundation of Affordable Homeownership

Before you embark on your home-buying journey, it’s crucial to have a clear understanding of your financial situation. This involves:

- Assessing Your Income and Expenses: Create a detailed budget that outlines your monthly income and expenses. This will help you determine how much you can realistically afford to spend on a mortgage and related costs.

- Checking Your Credit Score: Your credit score is a crucial factor in securing a home loan. A higher credit score translates to better interest rates and loan terms. Obtain your credit report and address any discrepancies or areas for improvement.

- Calculating Your Affordability: Use online mortgage calculators to estimate your potential monthly payments based on your income, down payment, and interest rates. This will give you a realistic range of properties you can consider.

- Saving for a Down Payment: The down payment is the initial amount you pay towards the purchase of your home. A larger down payment reduces your loan amount and monthly payments. Aim for at least 20% of the property value, if possible, to avoid private mortgage insurance (PMI).

2. Explore Government Schemes: Your Allies in Affordable Housing

The Indian government offers various schemes to promote affordable housing and assist first-time homebuyers. These schemes can significantly reduce the financial burden of homeownership. Some key schemes include:

- Pradhan Mantri Awas Yojana (PMAY): This flagship scheme aims to provide “Housing for All” by offering interest subsidies on home loans for eligible beneficiaries from Economically Weaker Sections (EWS), Low-Income Groups (LIG), and Middle-Income Groups (MIG). Check the PMAY website (https://pmay-urban.gov.in/) for eligibility criteria and application details.

- Credit Linked Subsidy Scheme (CLSS): A component of PMAY, CLSS provides upfront interest subsidies on home loans, reducing your EMIs.

- Affordable Housing Fund (AHF): Established by the National Housing Bank (NHB), AHF provides financial assistance to housing finance companies for promoting affordable housing projects.

- State-Specific Schemes: Many state governments offer additional housing schemes with benefits like stamp duty concessions and subsidized housing options. Research the schemes available in your state.

Ashapurna Buildcon’s projects are designed to align with these government initiatives, making them an ideal choice for first-time homebuyers seeking affordable options. Our team can guide you through the process of availing these schemes and maximizing their benefits.

3. Smart Strategies for Finding an Affordable Home:

- Prioritize Your Needs vs. Wants: Create a list of essential features you need in a home (e.g., number of bedrooms, location) and differentiate them from your “nice-to-haves.” Focusing on your needs will help you stay within your budget.

- Consider Smaller Properties: Opting for a smaller apartment or house can significantly reduce the purchase price and your monthly payments.

- Look Beyond Prime Locations: Properties in up-and-coming neighborhoods or slightly further from the city center often offer more affordable options.

- Explore Resale Properties: Resale homes can sometimes be more budget-friendly than new constructions. Ensure you conduct a thorough inspection to assess the property’s condition.

- Negotiate Wisely: Don’t hesitate to negotiate the price with the seller. Research comparable properties in the area to support your offer.

- Factor in Additional Costs: Remember to budget for additional expenses like registration fees, stamp duty, home insurance, and moving costs.

4. Ashapurna Buildcon: Your Partner in Affordable Homeownership

At Ashapurna Buildcon, we are committed to making the dream of homeownership a reality for everyone. Here’s how we can help you buy a house on a budget:

- Affordable Housing Options: We offer a diverse range of residential projects designed to cater to various budgets, without compromising on quality or comfort.

- Strategic Locations: Our projects are strategically located in areas with high growth potential, offering excellent value for your investment.

- Quality Construction: We adhere to the highest standards of construction, ensuring that your home is a long-term asset.

- Transparent Dealings: We believe in ethical practices and transparent transactions, providing you with a hassle-free and trustworthy home-buying experience.

- Customer-Centric Approach: Our team is dedicated to understanding your needs and providing personalized solutions to help you find the perfect home within your budget.

- Guidance on Government Schemes: We can assist you in navigating the complexities of government housing schemes and help you avail the benefits you are eligible for.

5. Managing Your Home Loan Effectively:

- Shop Around for the Best Rates: Compare home loan offers from multiple lenders to secure the most favorable interest rates and terms.

- Choose the Right Loan Tenure: A longer loan tenure reduces your monthly payments but increases the overall interest you pay. Choose a tenure that balances affordability with long-term cost.

- Consider a Fixed Interest Rate: A fixed interest rate provides stability and predictability in your monthly payments, protecting you from interest rate fluctuations.

- Make Prepayments: If possible, make prepayments towards your home loan to reduce the principal amount and shorten your loan tenure, saving you money on interest.

6. The Long-Term Benefits of Homeownership:

While buying a house on a budget requires careful planning and effort, the long-term benefits are substantial:

- Building Equity: As you pay off your mortgage, you build equity in your home, which is a valuable asset.

- Financial Security: Homeownership provides a sense of financial security and stability.

- Appreciation Potential: Real estate has historically appreciated in value over time, making it a sound investment.

- Personal Satisfaction: Owning your own home provides a sense of accomplishment and pride.

Your Journey to Affordable Homeownership Starts Here

Buying a house on a budget is achievable with the right approach and the right partner. Ashapurna Buildcon is committed to helping you navigate this journey with confidence and ease. Explore our range of affordable housing options and let us help you turn your dream of homeownership into a reality.

Discover the Ashapurna Buildcon difference. Your affordable dream home awaits.