Four walls and a roof are not all that make a house a home. Houses evoke many different emotions and thoughts. Depending on who you ask, it can be a sense of security for some, comfort for others, or even a symbol of status and success.

Additionally, one must also consider the other aspect of owning a home. These numbers factor into the equation. A home purchase is often the largest financial transaction in the life of an average Indian person. Renting versus buying is a decision that many people struggle with.

1. NO LANDLORD HASSLES:

A house of your own gives your complete control. There is no landlord to deal with; whether you need minor repairs or to completely remodel your home, living on rent can be a challenge. Everything you need, including water, electricity, maintenance, depends on the landlord.

2. EMOTIONAL SECURITY:

Purchasing a house provides your family with their very own space, a home. Even after a long day at work, coupled with a routine commute and constant stress, returning to your own nest offers a feeling of comfort and security that cannot be replaced. You can’t really be yourself anywhere else but at home where you feel at ease.

3. NO UNCERTAINTY:

When you own your own home, there is no worry and anxiety caused by the possibility that the lease agreement might be terminated prematurely by the landlord. The rent agreement does not need to be renewed annually, nor does the rent need to be renegotiated every time.

4. NO COMPROMISE:

Rent is an expense, and the tendency is to cut expenses whenever possible. Consequently, you may compromise on a number of aspects such as location, size, and amenities. A home purchase, on the other hand, will ensure that you get exactly what you want.

5. SIMPLE FINANCING OPTIONS:

Now that there are easy financing options, it has never been easier to own the home of your dreams. Saving up money for a dream house doesn’t have to wait until you’re 40 or 50. By the time you turn 50 or even before, you’ll have a fully paid off home to be proud of. If you need to manage your home loan repayments efficiently, you should choose a lender that allows you to customize your EMI according to your present and future income patterns.

6. TAX BENEFITS ON HOME LOAN:

Repayment of the principal and interest on your home loan earns you attractive tax breaks. Lastly, remember that paying rent alone is more expensive than paying principal and interest on your mortgage. It is more expensive because you will not be earning any interest on the deposit you paid to the landlord (which is quite high in premium locations).

7. BUILDING YOUR OWN ASSET:

If you would like to build an asset over time instead of paying rent, you can pay the EMI on a home loan. By doing so, you increase the equity in your home with every EMI you pay.

8. HOME AS AN INVESTMENT:

If you intend to live in a certain city for a long time, it makes sense to own a house, so you feel at home and established. By owning a house, you identify with the lifestyle of this city. It feels like you have finally made your home. In addition, house prices are frequently appreciated over time. As your wealth increases over time, you also benefit from purchasing a home. In addition to paying rent over an extended period of time, delaying the purchase of your property will result in having to invest more money.

9. CONFORMING TO SOCIAL NORMS:

The purchase of one’s own home represents accomplishment and success in society. You are classified by your home as either wealthy or successful. As a result, you can greatly improve your social status by purchasing a house.

10. PRICE APPRECIATION:

As the price of a house rises, over time, you see the difference between what you paid for the house and what it is worth today. The amount of appreciation could be considerable. In just a few years, the price could increase by $50,000 to $60,000. In the event that you ever need extra money, you could borrow against your home as part of your retirement strategy, nest egg, or if you want to put it to use as a source of income. Renting doesn’t provide you with that capability.

Conclusion

It doesn’t matter how you look at the question of renting or buying, buying makes the most sense. Buying a home now appears to be an attractive proposition due to increased income levels, higher disposable incomes, and the availability of easy and innovative mortgage options.

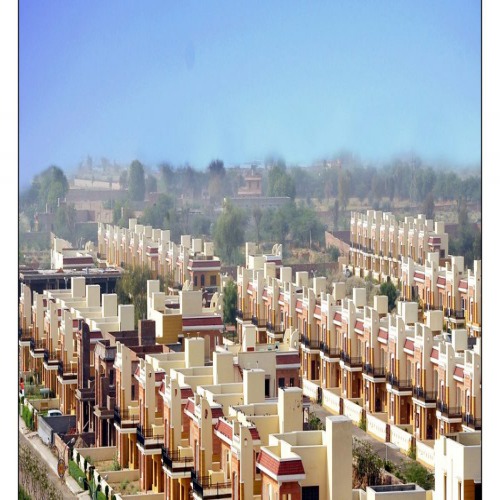

I Will recommend you to go for Ashapurna Buildcon as they are the Real Estate Developer in Jodhpur, and Top Developer in Jodhpur.

As far as my concerning its Awesome!

2 comments

codeiherbCam

October 14, 2022 at 10:05 am

this device

ashapurna-adminpanel

October 9, 2025 at 6:28 am

Hi,

Could we also receive a referral from your website? For any further information, please contact us at digital@ashapurna.com